Analysis: S&P 500 Rebounds to 5911 in Early June, After April's Pullback

Wall Street's shifting tides.

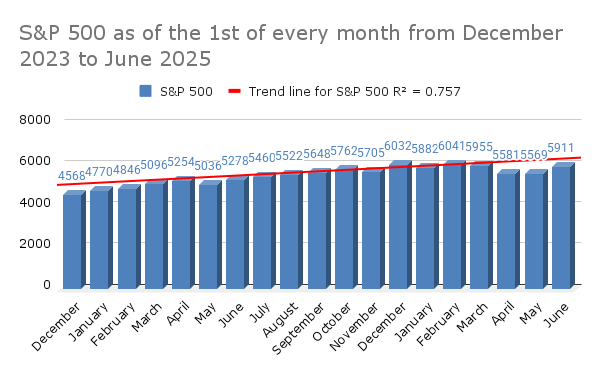

TL;DR - The S&P 500 saw a strong 2024 bull run (4568 to 6032). Early 2025 brought a sharp correction (February peak 6041 down to 5569 in May). Crucially, the index has rebounded to 5911 as of June 1st.

This rebound signals significant market resilience. The April-May dip appears to be a temporary correction, not a fundamental breakdown. It reinforces underlying confidence in U.S. equities, especially mega-cap growth names, despite brief periods of risk aversion. The data underscores the importance of:

Long-Term View: Short-term volatility is normal; avoid panic selling during dips.

Diversification: Essential to navigate market swings.

Active Risk Management: Continue to monitor macro factors to capitalize on opportunities and manage downside.

The market's quick recovery reaffirms its capacity for growth after absorbing headwinds.

The S&P 500, a bellwether for the broader American economy, closed December 2023 at 4568, embarking on a spirited climb throughout much of 2024. By April of last year, the index had surged to 5254, signaling strong investor confidence and a period of sustained growth.

A brief dip in May 2024 to 5036 proved to be merely a pause, as the market quickly regained momentum, culminating in a striking high of 6032 by December 2024. This performance underscored a remarkably bullish environment, likely fueled by robust corporate earnings, tempered inflation expectations, or perhaps the lingering optimism of a soft landing for the economy.

However, the new year initially presented a more complex narrative. While January 2025 saw a slight dip to 5882, the index rebounded to 6041 in February, briefly touching a new zenith.

Yet, the subsequent months told a story of apprehension: March brought a minor retreat to 5955, which then accelerated into a more substantial decline in April, landing the index at 5581. May 2025 saw the S&P 500 largely holding steady at 5569, a modest stabilization but still significantly below its February peak.

Now, the latest projection for June 1st, placing the index at 5911, suggests a notable rebound from the April and May levels. This renewed upward movement indicates that the market may be finding its footing sooner than some had anticipated, potentially alleviating some of the recent concerns.

This recent trajectory suggests that while the powerful forces that propelled the market upward through much of 2024 may have faced headwinds in early 2025, a degree of resilience remains.

Analysts will be closely scrutinizing a range of factors that could be contributing to this renewed optimism, including any fresh economic data, corporate earnings outlooks, or shifts in Federal Reserve policy expectations. Geopolitical tensions, particularly those impacting global supply chains or trade relations, also remain a perennial shadow over market forecasts, even amidst renewed bullishness.

For investors who experienced the volatility of April and May, the early June figures offer a glimmer of renewed confidence.

While a healthy correction is often seen as a necessary recalibration, the current data invites questions about the underlying health of the economy and whether this recent rebound represents a sustained recovery or a temporary bounce.

The coming months will undoubtedly offer further clarity on whether the S&P 500 can maintain its upward trajectory and if the bullish winds of last year have truly returned.